HK MAINTAINS FINANCIAL RANKING

24-3-2022

Alphabetical Index

依字母搜索

Hong Kong maintained third place globally in the Global Financial Centres Index (GFCI) 31 Report published today by Z/Yen from the UK and the China Development Institute from Shenzhen.

In a statement, the Government said the report reaffirms Hong Kong's status and strengths as a leading global financial centre.

It noted that Hong Kong remains among the top in various areas of competitiveness, including business environment, human capital, and infrastructure.

The Government pointed out that Hong Kong's financial markets have been functioning in an orderly manner with no abnormal signs of capital flow observed despite the persistent uncertainties stemming from the COVID-19 pandemic and heightened geopolitical tensions which continue to affect global financial markets.

It explained that the city’s robust and effective regulatory regime, a well-established institutional framework for systemic risk monitoring and the well-functioning Linked Exchange Rate System underpinned by large foreign exchange reserves have helped Hong Kong in this regard.

It added that Hong Kong's unique advantages, including institutional advantages under “one country, two systems”, a fine tradition of rule of law, and a market-oriented and internationalised business environment, coupled with robust infrastructure support, internationally aligned regulatory regimes, a full range of financial products, and free flow of information and capital, have continued to consolidate Hong Kong's status as a leading global financial centre.

The Government also noted that the National 14th Five-Year Plan expresses staunch support for Hong Kong to strengthen its functions as a global offshore renminbi business hub, an international asset management centre and a risk management centre, as well as to deepen and widen mutual access between the financial markets of Hong Kong and the Mainland.

Last year, the Government implemented various mutual access programmes with the Mainland financial markets, including the Cross-boundary Wealth Management Connect, the Southbound Trading under Bond Connect and the MSCI China A50 Connect Index futures contract.

The Government stressed that it will continue to make good use of national policies and the city’s own advantages and take the Guangdong-Hong Kong-Macao Greater Bay Area as an entry point, proactively exploring the Mainland market and participating in the domestic circulation of the national economy.

At the same time, Hong Kong will play its bridging and platform role at the intersection of domestic and international circulations, connecting domestic and foreign markets and investors, and assisting Mainland enterprises to explore the international market.

PREVIOUSNEXT

Latest Business News

最新商業資訊

HK to become IP trading hub: FS 26-4-2024

At a reception hosted by the Intellectual Property Department to celebrate World Intellectual Property (IP) Day today, Fi...

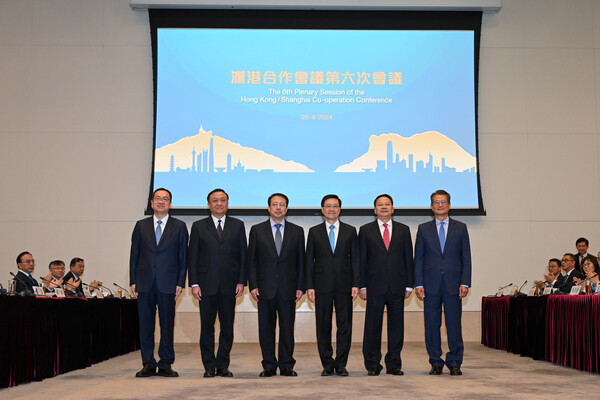

HK-Shanghai links strengthened 26-4-2024

Chief Executive John Lee and Shanghai Mayor Gong Zheng, leading delegations of the governments of the Hong Kong Special A...

Grant scheme extended 26-4-2024

The Government and the Securities & Futures Commission today announced details of the extension of the Grant S...

HK, Shanghai boost financial ties 25-4-2024

Representatives of the governments, financial regulators and exchanges of Hong Kong and Shanghai held the ninth Working M...