INSTITUTIONAL GREEN BONDS ISSUED

18-7-2024

Alphabetical Index

依字母搜索

The Government today announced the successful offering of approximately HK$25 billion worth of green bonds denominated in renminbi (RMB), US dollars and euros under its Sustainable Bond Programme.

The bonds, which have been assigned credit ratings of AA+ by S&P Global Ratings and AA- by Fitch, are expected to be settled on July 24 and listed on the Hong Kong Stock Exchange and the London Stock Exchange.

Following a virtual roadshow on Tuesday, the bonds were priced yesterday, the Monetary Authority said.

They include an RMB2 billion 2-year tranche at 2.6%, an RMB2 billion 5-year tranche at 2.7%, an RMB2 billion 10-year tranche at 2.8%, an RMB2 billion 20-year tranche at 3.05%, an RMB2 billion 30-year tranche at 3.15%, a US$1 billion 3-year tranche at 4.336%, and a EUR750 million 7-year tranche at 3.379%.

The offering attracted participation from a wide spectrum of investors globally, with the equivalent of more than HK$120 billion being received in orders.

Financial Secretary Paul Chan said the issuance of Government green bonds is an important initiative to promote Hong Kong's low-carbon transformation and consolidate the city’s development as a green and sustainable finance hub.

“Global institutional investors responded enthusiastically to the subscription of these green bonds, reaffirming our efforts on this front,” he said.

“The inaugural offering of the 20-year and 30-year RMB bonds helps to extend the offshore RMB yield curve, further enrich offshore RMB product offerings, and promote RMB internationalisation in an orderly manner.”

PREVIOUSNEXT

Latest Business News

最新商業資訊

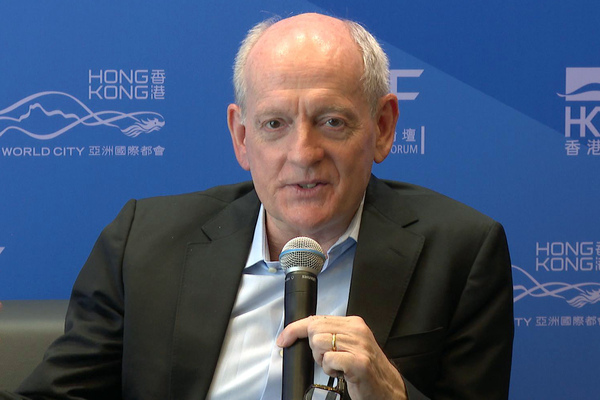

AI a new engine for economic growth 14-1-2025

The 18th Asian Financial Forum (AFF) continued today at the Convention & Exhibition Centre with a keynote luncheon on...

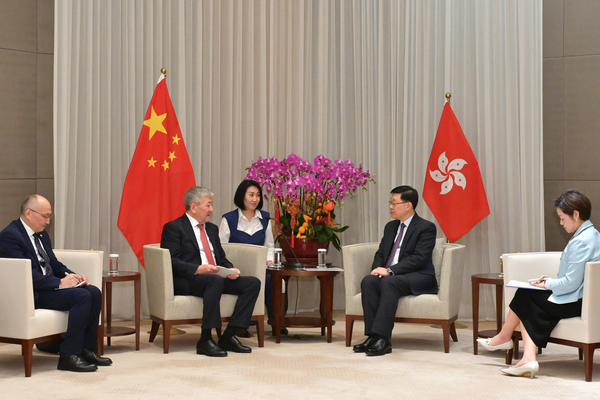

CE meets forum speakers 14-1-2025

Chief Executive John Lee today met another visiting senior official of a foreign government who was one of the speakers a...

Tech chief tours Shanghai university 14-1-2025

Secretary for Innovation, Technology & Industry Prof Sun Dong visited Shanghai Jiao Tong University (SJTU) today.

...Gulf-HK financial ties explored 14-1-2025

The first-ever Gulf Cooperation Council (GCC) Chapter was successfully held at the Asian Financial Forum today to ex...